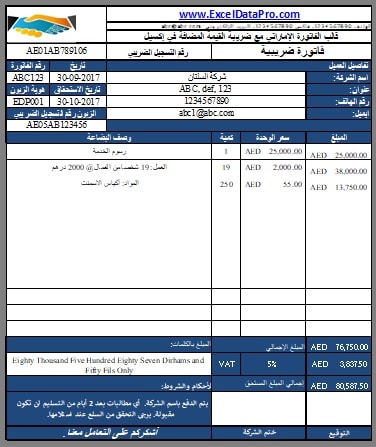

The inclusion of VAT is mandatory for the licensed registered businesses and the VAT Tax Excel Invoice Format can be effective in telling your customers how much amount is exactly being paid as tax. Bilingual UAE VAT Invoice is an excel template with predefined formulas. It consists of every detail in English and Arabic language. Bilingual UAE VAT Invoice can be helpful for those businesses who have Arab customers. If in any case, the FTA demands the audits of the firm documents, it can be helpful to government departments also. We have created the UK VAT Dual Currency Invoice excel template with predefined formulas that will help you to issue the invoice with 2 currencies. One is Sterling Pound and another currency whichever is applicable. A dual currency invoice is prepared when the goods or services supplied are from a foreign location or in foreign currency. Dec 12, 2019 Download in Excel Format GST Tax Invoice format for goods.xlsx TAX INVOICE ON GOODS LOCAL 2 TAX INVOICE ON GOODS CENTRAL 2. Comparison of GST Invoice with Vat. Tax Invoice Format in Word, Excel, PDF Format All types of Free Download Tax Invoice Format in Excel, Word, Pfd and other bill Format like.xls,.doc,.pfd. Whenever the goods or services of the supplier are buying and sale,a Tax of sale must create. As per current GST rules and GST acts.

All types of Free Download Tax Invoice Format inExcel, Word, Pfd, and other bill Formats like .xls, .doc, .pfd. like

Tax Invoice Format Purpose of Pro Forma Invoice, Performa Invoice, Format Invoice, Invoice Zoho, G S T Invoice Format, Invoice Format With Gst , Invoice Generator, Tax Invoice, An Invoice Template, Invoice Formats In Excel , Excel Invoice Format , Invoice With Gst , Sample Invoice, Invoice Software, Invoice Mart.

Whenever the goods or services of the supplier are buying and selling, a Tax Invoice Formatof sale must create. As per current GST rules and GST acts.

This type of invoice is terns and conditions as a GST Invoice. The seller must create a Tax Invoice Format and sending a Tax Invoice Format to the buyer which was affected across India on 1st July 2017. Sale Invoice, Creating Invoice, Free Invoice, Invoice Printer, Invoice Design, Invoice Manager, Invoice Maker Free, Invoice Generator Gst, Invoice Model, Custom Invoice, Cash Invoice, Digital Invoice, Mobile Invoice

GST Customer Care Number: Click Here

Online GST Registration toClick Here

GST Bill or GST Invoice in Excel (.xls ) Download

GST Bill or GST Invoice in Word ( .doc ) Download

GST Bill or GST Invoice in PDF (.pdf) Download

Our Important Tropic

| Invoice | Invoice Meaning | Invoices Generator Online |

| Tax Invoice Format | Bill Format | Bill Template |

| Invoice Generator | Invoice Proforma | Gst Invoice Format |

What are the mandatory fields that need an Invoice or Tax Invoice Format?

A tax invoice normally processes to apply the tax on the input tax credit an Invoice for Gst must have the following mandatory fields-

1. Bill or Tax Invoice Format Number and Date

2. Customer or Party Names / named

3. Full Billing addresses / addressed

4. Customer and taxpayer’s GSTIN number

5. Place of supply

6. HSN Codes / SAC codes / Accounting Code

7. Item details description,

8. Quantity of Goods Supplier,

9. Unit of Goods

10. Total Goods Rate

11. The Gross value of Goods

12. Total Taxable values / valued and discounts

13. Rate of Tax (CGST/ SGST/ IGST)

Vat Invoice Format In Excel Pdf

14. Signature of the supplier.

15. Company Pan Number

The minimum amount issue in an Tax Invoice Format–

A Tax Invoice Format can not issue when the bill value of the goods or services of a buyer is less than Rs 200 if –

- the goods or services of a buyer is unregistered and

- the goods or services of a buyer does not need any invoice, in case if the goods or services of a buyer demands the invoice, must issue.

What are the other types of invoices?

Tax Invoice Format of Purchaser or Supplier

The Tax Invoice Format of Purchaser or Supplier is similar to a GST Invoice as following conditions that bill of purchaser or supplier does not contain any tax amount as the seller cannot charge any GST amount to the Purchaser or Supplier.

- GST goods/services are selling to Register Persons,

- Also, Composition scheme has applicable for Register Persons

Types of Bill Compliance Invoice

Providing on the nature of the supply or services you can define 3 types of Invoice :

- State Bill

- Inter-State Bill

- Export Bill

Copies of the Invoice need

You can find the Invoice Copies;

| Supply of Goods | Supply of Services |

| Original Invoice: The original Bill provides to the buyer, and is remarked as ‘Original for buyer’. | Original Invoice: The original Invoice is provided to the buyer and is remarked as ‘Original for buyer’. |

Duplicate copy: The duplicate copy is provided to the transporter, and is remarked as ‘Duplicate Copy. This is not issuing if the buyer has received a bill reference number. The Invoice reference number is given to a buyer when he uploads a tax bill that is provided by him in the GSTR-1 for GST filing. This Invoice is valid for 30 days from the date of the upload of the bill. | Duplicate copy: The duplicate copy is provided to the transporter, and is remarked as ‘Duplicate Copy. |

| Triplicate copy: This copy is kept by the buyer, and is marked as ‘Triplicate Copy’. |

Searches related to Tax Invoice or Invoice

Bill format in excel

The GST Bill rules

GST declaration on the invoice

The GST Bill serial number rules

The invoice format in excel download

The tax invoice format in excel free download

The GST Bill Format in word

GST Bill rules 2019

Filing Invoice on GST Portal

The Invoice a serial number of all invoices issued during a tax period of every month should be filed in FORM GSTR-1. Also, GSTIN of all recipients registered under GST must be mentioned on GSTR-3B and also filing on GSTR-1 for every bill filing to B2B transactions with party name, bill no, bill date, rate of GST, gross amount, total bill amount.

In the case of recipients, unregistered persons under GST bill filing to B2C other transactions, name, address, and place of supply should be mentioned for high-value transactions. And all Gst bill of register person show in Gst Portal GSTR -2A

Supplementary Sale Bill / Debit Note

Whenever the party is any type of correction in prices of a total good or total service supplied earlier and the same was priceable to the GST portal, then the supplier is liable to issue a supplementary bill to the buyer.

Vat Invoice Format In Excel Sheet

The said the supplementary bill must issue within 30 days from the date of such total price revision. Also, it is mention in the filing of the monthly return GSTR-1 portal.

Supplementary Purchase Bill / Credit Note

Just like the debit note where there is an update revision in the total price, a credit note has to be provided when there is an update revision of the total price. GST should have filed in the previous transaction. The credit note must provide on or before 30th September of the next financial year or before total filing the annual return of GST, whichever is advance.

The Invoice of these documents is the same as earlier the total invoice. The only most difference is that the nature of the total bill must mention in more spacially on top of the bill.

Time Limit for providing Invoice

Under the GST rules, there are specified time periods during which GST Bill must be necessarily provided. The following are the GST invoice proving time limits that one needs in mind:

- In the case of goods supplied, you need to provide GST Invoice on before the date of goods removal/ goods delivery.

- In case of services issue, you need to issue GST Invoice within 30 days of issuing the service.

- If services have issued by banks and NBFCs, they are required to provide a valid under GST Bill within 45 days of issuing the service.

People also ask

You can find ask a question on Invoice

1. What is the GST invoice format?

2. How do I do GST billing?

3. What is the current GST rate in India?

4. Is the handwritten bill allow in GST?

5. What is a new GST rules?

6. How do I calculate GST?

7. What is GST compliant invoice?

8. How many digits is a GST invoice?

9. What is Lut in GST?

10. Which GST software is best?

11. What is the rule of GST?

12. Which items are exempt from GST?

13. What is the GST bill with an example?

14. Which products are out of GST?

15. What are the 3 types of GST?

16. What is the GST rate for machinery?

Vat Invoice Format In Excel Download

Tax Invoice Format in Word, Excel, PDF Format All types of Free Download Tax Invoice Format in Excel, Word, Pfd and other bill Format like .xls, .doc, .pfd. Whenever the goods or services of the supplier are buying and sale,a Tax of sale must create. As per current GST rules and GST acts. This type of invoice is terns and conditions as a GST Invoice. The seller must create a Tax Invoice Format and sending a Tax Invoice to the buyer which was affected across India on 1st July 2017.Tax Invoice Format free download in Excel, Word, Pfd, and other bill Formats like .xls, .doc, .pfd. like Invoice Maker Free, Invoice Generator

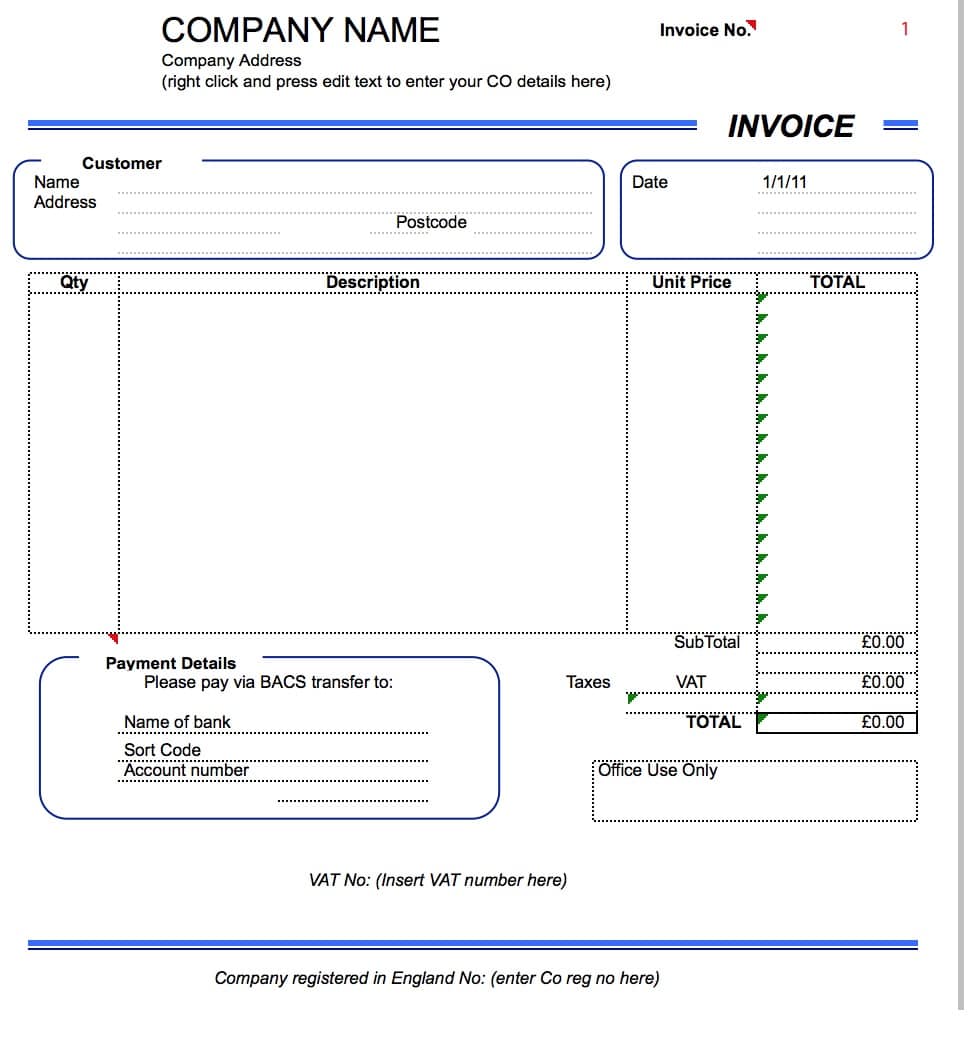

In making business transactions, we all need an invoice to claim the VAT we paid for. A VAT invoice includes all the details of the purchases made and the services provided. VAT is a very useful component for the companies as the taxes can be recovered from such companies. Businesses exceeding a certain limit of revenue have to register for VAT. Not doing so can result in non-compliance to the government.

Businesses voluntarily register for VAT even when they do not have to. It will get them a benefit of not crossing the threshold at any time and avoid any penalties and fines. Starting a new business can be challenging but businesses who register for VAT get an edge from ordinary small businesses. But registering for VAT can help the business get external finances from venture capitalists as well as banks.

Not only is getting finance easier for VAT registered companies but some vendors and customers also do not like doing business with companies that are not VAT registered. So by registering for VAT, the business will hold a specific VAT number which makes it easy to do business with third parties.

VAT is also very helpful when making purchases globally. The amount spent can be recovered using the VAT number. Tax-free purchases or the purchases on which tax can be recovered always bring a lot of comfort for the buyers.

VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered.

The VAT invoice is a document that notifies an obligation to make a payment. A registrant or registered taxpayer means a taxable person who is registered for VAT and is required to charge VAT and file VAT returns on time. A few requirements are to be fulfilled for making a good and considerable VAT invoice. The requirements are mentioned below.

The invoice must open with the name and logo of the company along with the contact details like address, contact number, and VAT number that the company has. The numeric-like date on which the invoice is issued and the invoice number must be correctly placed where it can be seen properly.

Name of the person company interested in VAT invoice must be written on the top under the company details, in block letters for better illegibility. The name must be followed by contact details like address, phone number, city and ZIP code, etc.

A few columns must be drawn out to give a detailed view of what product or service the VAT is applied on, along with the product ID. Another column must be specified to apply the VAT rate and the VAT amount must be mentioned separately for each item. Then, in the end, the amount totaled to be paid must be written properly where it can be seen and read without any confusion.

A VAT invoice includes:

- Company name

- Contact details of the company

- Customer details

- Description of the purchase/services

- Unit price and quantity of a purchased item

- VAT rate applicable

- VAT registration number

- Terms & conditions of payment

- Mode of payment

Preview

VAT Invoice Template

For: EXCEL(.xls) 2003 & later [Android+iOS] & iPad

DownloadFile Size: 40 kb

For: OpenOffice Calc [.ods] | Download File Size: 19 kb

[Personal Use Only]